Buying Guide

Buying a Property with Cash

There are several attractions for foreigners to purchase properties in Japan. Japan's reputation for safety and cleanliness is attractive to foreigners, especially those with families or those seeking a peaceful living environment. Some foreigners are drawn to purchasing properties in Japan due to their strong affinity for Japanese culture, lifestyle, and the opportunity to immerse themselves in the country's unique way of life.

Unlike some of the other countries in the world, taxes and various purchase costs of buying properties are the same for foreigners as for any Japanese, and so are the costs to own one. Also, Japan has a well-established legal system that protects property rights and ensures a fair and transparent process for property transactions which gives people a sense of security to invest their money in Japanese real estate.

However, how property transactions are done in Japan may be different from how they are done in other countries, such as, instead of lawyers and escrows playing a vital role in transactions, real estate agents and judicial scriveners (司法書士, shihō shoshi) take on that role. Sales contracts are drafted by the real estate agent using the standard formats provided by their member real estate organization and not by lawyers. Your deposit or purchase money is paid to the seller directly and not to an escrow or lawyer. However, the judicial scrivener will conduct due diligence to verify the ownership status, property details, and any existing liens or encumbrances on the property before you make your payment, ensuring that there are no legal issues or disputes related to the property. Judicial scriveners are also responsible for registering property transactions with the appropriate government offices and see through that the ownership title will be transferred to you once your purchase payment is made.

Here is the step-by-step process of buying a real estate property in Japan.

Buying Flowchart

Sort out your funding

Find out how much your various purchase fees will cost and decide how much you want to spend.

Initiate your property search

Contact an agent and initiate your property search.

Receive the Explanation of Important Matters, sign the sales contract, and pay the deposit

Receive the Explanation of Important Matters (重要事項説明書, Jyu-yo-jiko-setsumei-sho) from a licensed broker, sign the sales contract, and simultaneously pay the seller the deposit (手付金 Tetsu-kay-kin). The deposit amount is capped at 10% of the purchase price.

Perform final check of the property

Perform final check of the property with the seller. You will not want any doubts remaining before closing the deal and should ideally have them all brought up at this time.

Settle the outstanding balance of the purchase price and all other fees which are due

Settle the outstanding balance of the purchase price and split fees (清算金 Sei-san-kin) with the seller reckoned on the closing day, such as property taxes and monthly apartment fees. You will also need to pay all other related closing fees which are due at the same time.

Receive delivery

Receive the keys.

Execute ownership title transfer

Immediately after the payment and delivery, an entrusted judicial scrivener (司法書士 Shiho-shoshi) with the necessary documents from both parties will go to the Legal Affairs Bureau to legally transfer the property ownership title.

Pay any acquisition fee that may arise post-sale

Acquisition tax (不動産取得税 Fudosan-shoe-toku-zei) will be imposed on you, if there is any, by the local tax office within 1 – 3 months after purchase.

Various Costs

Various Costs (4 - 7% of sales price, excluding "Post-sale fees" and "Fees incurred yearly")

When signing the contract

・ Deposit (手付金 Tetsu-kay-kin) up to 10% of the sales price

・ Stamp duty (収入印紙 Shu-new-inshi) for sales contract (corresponds to the sales price)

When settling the outstanding balance of sales price (closing)

・ Ownership title transfer registration tax

・ Building description registration and ownership preservation tax (for new building purchase)

・ Agency fee {( Sales price×3%) + 60,000Yen} + consumption tax

・ Judicial scrivener fee

・ Pro-rated annual property tax of the year of sale

・ Pro-rated monthly apartment fee of the month of sale (apartments only)

・ Housing insurance premium (your choice of 1 to 5-year term, with or without earthquake coverage)

Post-sale

・ Property acquistion fee (不動産取得税 Fudosan-shoe-toku-zei) imposed 1 - 3 months after closing)

Fees incurred yearly

・ Fixed asset tax towards land and building

・ City planning tax towards land and building

Necessary Items

Necessary Items for Buying

・Residence certificate (住民票 Ju-min-hyo) 1*

・Non-registered seal (認印 Mitome-in) 2*

・ID (residence card, passport, and other photo ID) 3*

When will you need it

1* upon closing

2* upon contract signing and closing

3* upon contract signing and closing

Buying a Property with Loan

Since Japan introduced a new work visa category known as the Highly Skilled Foreign Professional Visa, it has become easier for foreign nationals to obtain permanent residency (PR) after 1 or 3 years of stay in Japan. This shift towards relaxed requirements is to help address issues due to Japan’s aging population and labor shortage. One of the benefits for a foreign national to possess permanent residency is to be able to borrow mortgage loans from most major banks at very low competitive interest rates, and this has encouraged many to switch from renting to buying. There are a few banks that will lend mortgage loans to non-PR visa holders, but no banking institutions in Japan will grant mortgage or investment loans to foreigners who do not work and hold a long-term work visa.

Between PR and non-PR borrowers there is usually a difference in how much they can borrow. PR holders are granted greater loan amounts with more competitive rates, and it may even be feasible to borrow for the various fees associated with the purchase. Each bank has its own upper borrowing limit, and this will be affected by the bank’s assessment of the property, the borrower’s income, and other eligibility requirements. If you are not able to secure a loan with a sufficiently high LTV (loan-to-value) ratio, you may have a funding shortfall which will then require you to make additional down payments in cash.

Bank Options

Foreigners with Permanent Residency

Most banks in Japan will lend home mortgage loans to permanent residence visa holders who have worked full-time for at least 1 or 2 years. If you have changed jobs during this time, you are still eligible if there is no interruption in your employment status. Business owners who have run a profitable business for several years in Japan are also eligible with most banks. But even for business owners who are still growing their business that has not yet reached profitability, they may be able to take out a loan called Flat 35 (フラット35 flat-35) from the Japan Housing Finance Agency. Some banks will require borrowers to be able to speak and read Japanese, but others are fine as long as you have an interpreter present at meetings. You should be able to obtain the same competitive loan interest rates and loan periods as any Japanese.

Foreigners without Permanent Residency

There are several banks such as SMBC Trust Bank, SBI Shinsei Bank, and Suruga Bank which you can borrow from. But for SBI Shinsei Bank, you are eligible only if you have a spouse who is a Japanese citizen or permanent residency holder. You may be limited in your lending amount or charged higher interest rates compared to someone with a PR status. In addition, you should set aside 5-10% of the purchase price for various purchase costs. You may need a large amount of cash saved up when buying Japanese property without PR.

Loans for Offshore Buyers

There are no banking institutions in Japan that will grant mortgage or investment loans to foreigners who do not work and earn money in Japan and hold a long-term work visa.

Necessary Items for Loan Application

* loan application form has to be filled out in Japanese

If you file income tax returns in Japan

・ Latest 2 years’ income tax returns (確定申告書 Kakutei-shinkoku-sho)

・ Latest 2 years' of income tax certificate (課税証明書 Kazei-shomei-sho)

If you don’t file income tax returns in Japan

・ Latest withholding tax slip (源泉徴収票 Gensen-choshu-hyo) issued from company

・ Latest income tax certificate (課税証明書 Kazei-shomei-sho)

Commonly required items

・ Residence certificate (住民票 Ju-min-hyo)

・ Registered seal (実印 Jitsu-in)

・ Seal certificate (印鑑証明書 Inkan-shomei-sho)

・ Medical exam (if loan exceeds 100 million yen and/or opt for cancer-specific homeowner's life insurance)

・ Required real estate documents (sale and purchase agreement, ownership registration, property inspection certificate, building plans, etc.) will be submitted by your agent.

Buying Flowchart

Consult with banks and sort out your funding

Find out which banks will lend to you and how much you can borrow. For any shortfall, you will have to cover it with cash so make sure you have savings. On the other hand, you may be able to borrow well over 100% of your purchase price depending on the bank’s assessment of the property plus your income, which can then be used to cover your various purchase costs to a certain extent. Bear in mind each bank has its own upper borrowing limit for the various purchase costs.

Initiate your property search

Contact an agent and initiate your property search.

Make an offer and start your preliminary loan application

Submit a letter of intent to purchase (購入申込書 Ko-new-mow-shi-komi-sho) when you have found the right property and start your preliminary loan application with a bank if you have come to terms with the seller. The seller will not engage in any sales contract without your approved preliminary loan application.

Receive Explanation of Important Matters, sign the sales contract, and pay the deposit

Receive the Explanation of Important Matters (重要事項説明書 Ju-yo-jiko-setsumei-sho) from a licensed broker and sign the sales contract, and simultaneously pay the seller the deposit (手付金 Tetsu-kay-kin). The deposit amount is capped at 10% of the purchase price, but any amount more than 5% could be accepted at a high chance.

When you take out a loan, there will be a mortgage contingency (ローン特約 Loan-toku-yaku) in the sales contract stating if and when you are unable to obtain the desired loan amount, you may withdraw from the contract without paying a penalty.

In this event, the deposit will be refunded from the seller promptly. However, the buyer cannot for one’s own convenience deliberately prevent oneself from being approved for the loan.

Complete the official loan application with your bank, and once accepted, conclude your loan contract

Start the official loan application with the bank after signing the sales contract. When the loan is approved, open a bank account with your lending bank and conclude the loan contract.

Perform final check of the property

Perform final check of the property with the seller. You will not want any doubts remaining before closing the deal and should ideally have them all brought up at this time.

Settle the outstanding balance of the purchase price and all other fees which are due

Settle the outstanding balance of the purchase price and other split fees (清算金 Sei-san-kin) with the seller reckoned on the closing day, such as property taxes and monthly apartment fees. You will also need to pay all other related closing fees which are due at the same time.

Receive delivery

Receive the keys

Execute ownership title transfer

Immediately after the payment and delivery, an entrusted judicial scrivener (司法書士 Shiho-shi) with the necessary documents from both parties will go to the Legal Affairs Bureau to legally transfer the property ownership title, and to register your lending bank’s mortgage rights onto your property.

Various Costs

Various Costs (6 - 9% of sales price, excluding "Post-sale fees" and "Fees incurred yearly" )

When signing the contract

・ Deposit (手付金 Tetsu-kay-kin) up to 10% of the sales price)

・ Stamp duty (収入印紙 Shu-new-inshi) for sales contract (corresponds to the sales price)

When settling the outstanding balance of sales price (closing)

・ Ownership title transfer registration tax

・ Building description registration and ownership preservation tax (for new building purchase)

・ Agency fee {( Sales price×3%) + 60,000Yen} + consumption tax

・Judicial scrivener fee

・ Pro-rated annual property tax of the year of sale

・ Pro-rated monthly apartment fee of the month of sale (apartments only)

・ Housing insurance premium

・ Bank fee (either under the name of guarantor fee or loan processing fee)

・ Mortgage registration tax (抵当権設定登記費用 Teito-ken-settei-toki-hiyo)

・ Stamp duty for loan contract (corresponds to the loan amount)

Post-sale

・ Property acquisition fee (不動産取得税 Fudosan-shutoku-zei) imposed 1 - 3 months after

Fees incurred yearly

・ Fixed asset tax towards land and building

・ City planning tax towards land and building

Necessary Items for Buying

Necessary items

・ Residence certificate (住民票 Ju-min-hyo) 1*

・ Registered seal (実印 Jitsu-in) 2*

・ Seal certificate (印鑑証明書 Inkan-shomei-sho) 3*

・ Non-registered seal (認印 Mitomay-in) 4*

・ ID (residence card, passport, or other photo ID) 5*

When will you need it

1* upon bank loan contract signing and closing

2* upon bank loan contract

3* upon bank loan contract

4* upon sales contract signing and closing

5* upon sales contract signing and closing

If you take out a housing loan, you can potentially have a deduction of 0.7%* of your remaining loan balance each year from your income tax for 10years, the upper limit being 140k* per year, if you satisfy the following requirements:

* The maximum deduction and the period of deduction will be extended based on the level of energy efficiency of the building.

Borrower’s Eligibility

1. Your property purchase is before December 31, 2030.

2. Your total annual gross income is under 20 million yen (10 million yen in some cases).

3. You have an outstanding balance at the end of each eligible year.

4. You commence residing in your purchased property within 6 months of acquisition.

5. You do not benefit from any other tax breaks within 3 years counting from the year before the sale,

Housing Loan Requirements

1 The loan is for purchasing your primary residence (自己の居住用 Jiko-no-kyo-ju-yo) on a freehold lot.

2. The initial loan term has to be more than 10 years.

Requirements for the Property

1. One half of the building floor space has to be used as residence.

2. The total floor space has to be more than 50m2(*).

3. It needs to be built after Jan 1, 1982. Properties built before that date must meet the new earthquake code (耐震基準 Taishin-kijun) verified by seismic diagnosis.

*It can be between 40 - 50sqm if some specific conditions are met, but in that case your total income must be less than 10 million yen.

Avenue Far East is neither qualified nor authorized to give legal or tax advice, and any such advice shall be obtained from an appropriate, qualified professional advisor of your own choosing. Moreover, the stated requirements may be revised at any time and the information contained here may not be up to date. Therefore, it should be used for reference only.

Buying Property as an Offshore Buyer

Buying a property in Japan as a non-resident (非居住者 He-kyo-jusha) can present a few challenges. Having to make a few trips to Japan is one challenge, but the biggest challenge can be making an international money transfer which can take time and delays can affect the timing of settlement. Not only can it result in you not being able to meet your settlement deadline, but it can also make it difficult for payment and ownership title transfer to occur simultaneously or in close succession, as is generally advised.

Simultaneous payment and title transfer offers benefits and protections for both parties involved in the transaction, since you can obtain ownership title immediately once your payment is made, and the seller is able to transfer their ownership title as soon as your payment is received in full. Normally, you would not like any interruptions between payment and title transfer as that may potentially put you at some risk.

One way to avoid this is by entrusting a legal professional, your real estate agent, or your acquaintance in Japan to make payments for you to ensure a simultaneous payment and title transfer. But if you choose to make the payment yourself, one option is to negotiate with the seller to keep their title deed with a judicial scrivener (referred to as lawyer, escrow, etc., in other countries) approved by both parties. This will ensure the ownership title will not be transferred while your money is being transferred from overseas. Please note that not all sellers will be willing to accept such special arrangements when selling to a non-resident. If this is the case, you should consider entrusting someone to make the payment for you.

Buying Flowchart

Decide whether to take on the buying process yourself or entrust someone to represent you

Decide if you wish to delegate all or part of the powers related to the purchase to a legal professional.

Sort out your funding

Find out how much your various purchase fees will cost and decide how much you want to spend.

Initiate your property search

Contact an agent and initiate your property search.

Make an offer

Submit your letter of intent (購入申込書 Ko-new-mowshi-komi-sho) when you have found the right property

Prepare an affidavit for the property purchase

To prepare for your property purchase, obtain an affidavit (宣誓供述書 Sensei-kyo-jutsu-sho) from a notary public in your home country, or if you currently live abroad, then have it certified at the embassy.

If you entrust someone to sign the contract and give that person other related powers for your purchase, then the attorney-in-fact should be in possession of both the power of attorney (委任状 E-nin-jo) and affidavit.

Receive an Explanation of Important Matters, sign the sales contract, and pay the deposit

Receive the Explanation of Important Matters (重要事項説明書 Jyu-yo-jiko-setsumei-sho) from a licensed broker and sign the sales contract, and simultaneously pay the seller the deposit (手付金 Tetsu-kay-kin). The deposit amount is capped at 10% of the purchase price, but any amount more than 5% could be accepted at a high chance.

If you cannot come to Japan, a round-robin contract (持ち回り契約 Mochi-mawari-keiyaku) signing can possibly be arranged if the seller agrees to such an arrangement, or you can always delegate a legal professional to sign on behalf of you and simultaneously pay the deposit. If you are signing yourself remotely then in most cases you will be expected to make an international transfer for your deposit in advance by the seller’s planned signing date.

Settle the outstanding balance of the purchase price and all other fees which are due, and submit your affidavit to the judicial scrivener

Submit your affidavit to the judicial scrivener (司法書士 Shihosho-shi) who is delegated to transfer the ownership title, or send it in advance of the closing date if you will not attend the closing. Settle the outstanding balance of the sales price and split fees (清算金 Sei-san-kin) with the seller reckoned on the closing day, such as property taxes and monthly apartment fees. You will also need to pay all other related closing fees which are due at the same time.

Receive the delivery

Receive the keys

Execute ownership title transfer

Immediately after the payment and delivery, an entrusted judicial scrivener with the necessary documents from both parties will go to the Legal Affairs Bureau to legally transfer the property ownership title.

Pay any acquisition fee that may arise post-sale

Acquisition tax (不動産取得税 "Fudosan-shoe-toku-zei") will be imposed on you, if there is any, by the local tax office within 1 – 3 months after purchase. Appoint a tax representative (納税管理人"No-zei-kanri-nin") in Japan to help you pay the acquisition tax if it arises.

Various Costs

Various Costs (4 - 7% of sales price, excluding "Post-sale fees" and "Fees incurred yearly")

When signing the contract

・ Deposit (手付金 Tetsu-kay-kin) up to 10% of the sales price)

・ Stamp duty (収入印紙 Shu-new-inshi) for sales contract (corresponds to the sales price)

When settling the outstanding balance of sales price (closing)

・ Ownership title transfer registration tax

・ Building description registration and ownership preservation tax (for new building purchase)

・ Agency fee {( Sales price×3%) + 60,000Yen} + consumption tax

・ Judicial scrivener fee

・ Pro-rated annual property tax of the year of sale

・ Pro-rated monthly apartment fee of the month of sale (apartments only)

・ Housing insurance premium (your choice of 1 to 5-year term, with or without earthquake coverage)

Post-sale

・ Property acquistion fee (不動産取得税 Fudosan-shoe-toku-zei) imposed 1 - 3 months after closing

Fees incurred yearly

・ Fixed asset tax towards land and building

・ City planning tax towards land and building

Necessary Items

Necessary Items for Buying

・ Affidavit (宣誓供述書 Sensei-kyo-jutsu-sho) 1*

・ Power of attorney (委任状 E-nin-jo) *when entrusting someone with powers related to buying 2*

・ ID (residence card, passport, or other photo ID) 3*

When will you need it

1* upon sales contract signing and closing

2* upon sales contract signing and closing

3* upon sales contract and closing

Buying a New House

Buying a house could be buying a new home-and-land package from a developer, or purchasing a plot of land preconditioned to build a house with a builder appointed by the property developer.

First, when you buy a finished home-and-land package from a developer, you know exactly what you are buying. You know how big the rooms are, how much light the house gets in, and what the view looks like. In some cases, the developer may not start building the house until after the contract is signed, but the building plan is pre-drawn and you have no flexibility in altering it.

Generally speaking, the benefit of buying a newly built house from a developer is being able to acquire a house and land cheaper than you would when buying them separately. Economy of scale is in play when a developer builds multiple houses on a development site all at once, which will bring the construction costs down making them more affordable. In addition, a developer is likely to plan housing development projects in favorable locations which means the property may have locational advantages in some respects.

On the other hand, the downside of buying a newly built house is, you are unable to change the plan or the design. If you are buying a pre-built house, you may not have the opportunity to see the house being built and know if corners have been cut. Plus, new homes in recent years tend to be built on smaller lots, look identical to one another, and positioned very close together.

When you buy a newly built house from a property developer, it will come with a 10-year major structural defect warranty, and the warranty is given towards the foundation, exterior walls, roof, pillars, beams, and so on. The builder either takes out a latent defect insurance which will keep their warranty effective even if they go out of business during the warranty period, or deposit money into a third-party institution which maintains a pool of money for repairing latent defects detected in the future. Developers are also liable for latent defects of the interior sections of the house for 1 to 2 years or more, such as those in walls, floors, fittings, equipment, and so on, though each developer has its own warranty period and waiver conditions.

Next, if you plan to buy a plot of land from a property developer and build a house on it, you can choose your house design and materials from the available options. After first signing the purchase contract for the lot, you would normally have 3 months to come up with a mutually agreed plan with your property developer before signing the building (construction) contract; otherwise, both parties will have the ability to cancel the contract without paying the other a penalty for breach of contract.

However, in contrary to this normal process, many a time the developer will set up the land and building contracts to be signed concurrently, which prevents you from cancelling without paying a penalty. The developer in the majority of cases will have the upper hand, and it is not unusual for them to drive things in a way advantageous to them. Therefore, buyers should be watchful of this type of aggressive developers.

Buying a Pre-Owned House

When you buy a pre-owned house, it may limit your ability to customize the property according to your preference. You may need to compromise on certain features or undertake renovation work to align the house with your desired design and functionality. Normally, the seller will only offer a 3-month warranty for major structural defects. In addition, for the fittings and equipment, the buyer is usually given only 1 week to claim for damages which are not noted in the contract. For these reasons, it is best to hire a home inspector to look at the entire house and to find any underlying issues that may possibly burden you after you take possession.

Checklist of things you should be watchful of when purchasing a pre-owned house

-

Boundary Points

-

Road Access

-

Road Width

-

Height Differences with Adjoining Lots

-

Ownership of Boundary Walls and Fences

-

Transboundary and Buried Objects

-

Soil Contamination

-

Climate Risks

Boundary Points

Check if there are clearly marked boundary points with all adjoining lots, and find out who owns the boundary walls and fences. If there are any doubts regarding boundary lines with the neighbors, they should be cleared up by your seller before contract closing as this may create problems for you in the future.

It is always best to have an official survey map signed off by all adjoining landowners before contract closing, which documents that boundary points are marked off and they are mutually agreed upon. Even if there is no official survey map provided by the seller, there should still be visible boundary points, and you can ask the seller to point them out to you at the site. If there are any boundary points in question, the seller shall have it determined with the adjoining landowner before contract closing.

Road Access

Frontal road and frontages are also important aspects when searching for your property. You should determine not only how accessible the house is with your car, but also whether the frontal road is city approved or not. The latter tells you whether you will be allowed to newly build or re-build (collectively called “develop”) your house. If not, then you will not be allowed to develop a house on that site.

Moreover, the frontal road can either be a public or a private road, even if it is city approved. One thing to keep in mind when you become a joint owner of a private road is that, there may be rising costs to maintain the road which you will have to bear. Conversely, if you don’t own any share of the private road that your house fronts, and, for example, if your water pipes run underneath, you may need permission from the owner(s) to excavate the road when you need to fix or replace them, and you may be charged money for that. It is always best to have your seller obtain written permission from the owner(s) of the private road in advance to consent to you using and excavating the road when repair is needed.

The frontage of your property needs to be at least 2 meters wide (sometimes 3 meters is required depending on the length of the passage way), or else a house is not permitted to be developed if you want to rebuild. You should be watchful for land shaped like a flagpole/battle axe which has narrow street access. Points worth noting when you buy a house with a narrow street access are, you can be limited to the type of car you can park, and builders may not be able to access the lot with large vehicles carrying construction equipment, which will result in additional work costs for demolishing, redeveloping, remodeling your house in the future. Not to mention that you may be surrounded in all directions limiting the amount of light the house gets and the view, etc. However, this type of land is generally said to cost 20 -30% less than properties with wider frontages.

Road Width

Within a city-planned area, roads need to be at least 4 meters wide. If your existing frontal road is less than 4 meters wide, or its centerline is less than 2 meters from your lot (or more if stipulated otherwise), you will have to give up land space to make up for the deficit if you ever want to rebuild your house.

Height Differences with Adjoining Lots

You need to look out for any height differences with your immediate neighbors, as you may need to build an earth retainer to align the heights, or build a house with a deep foundation. If there are any old or deteriorating retaining walls between you and your neighbors, they may have to be put up anew if you rebuild as they may not be up to code. The cost for this could be anywhere between a few tens of thousands of yen to a few tens of millions of yen depending on the size, structure, materials used, location, etc. You also need to add the cost to remove the existing old walls. For this reason, be sure to find out who owns the walls with your neighbors if there is doubt on who needs to bear the costs of rebuilding them, so that you will be better prepared to stand your grounds.

Soil Conditions

It is important to know whether the soil in your block of land is strong or weak, which in turn provides your builder with the information needed for a suitable construction technique and the type and depth of the required foundation of the house. You should be cautious when the land is in low lying types of location where it can be affected by floods and heavy rain.

Whether it needs soil improvement or not will have a huge impact on the overall costs of your construction, and you may have a dispute with your seller in respect to who will bear the costs to improve it. Therefore, it may be a good idea to hire a soil engineer to perform soil testing prior to buying the land. However, the majority of sellers will not cooperate with such testing out of the fear that the results may be unfavorable and they may be asked to lower the sales price, or have to shoulder any costs of conducting such test.

You may also want to consider conducting a soil assessment to ensure that the plot of land does not have serious environmental problems such as contaminated soils or polluted water sources. Looking up old maps and closed registries can also tell you the history of the land and how it has been used.

Climate Risks

With recent global climate change, Japan, like many other countries, has suffered from severe floods from unprecedented rainfalls. It is extremely important to make sure your plot of land is not in a flood zone. Not only are floods seen typically in areas near rivers and oceans, but they may also be seen in low lying areas in inland locations, where wastewater treatment capacity cannot keep up with short-time heavy rainfalls which have become more common recently.

Loose saturated sand deposits which are found in reclaimed land, swamps, lagoons, former rivers, coastal regions of big rivers, natural embankments formed from past floods are all prone to liquefaction. Check to see whether or not the plot of land you are planning to buy is in a liquefaction zone which is extremely important in making your purchase decision.

Given that the prices of real estate in Tokyo are still not reflective of climate risks as much as they should, this is a sign of people’s low level of awareness towards frequently occurring natural disasters seen in recent years. It is best you avoid buying real estate prone to natural hazards which could diminish your property values. You should not be blindsided by how great the real estate may look.

Buying Land

If you want to custom-build your home, you should know whether your desired drawing plan can be constructed on the plot of land you plan to buy. Check the zoning (用途地域 Yo-to-chi-iki) rules so you know the local government’s determination of these following factors, which tells you what kind of house can be built on that plot of land.

Factors which tells you what kind of house can be built

-

Building Volume-to-Land Ratio

-

Height Restrictions

-

Minimum Lot Size

-

Setback Requirements

-

Fire Resistance Requirements

Land-to-Building Ratio

Land-to-building ratio (建ぺい率 Ken-pei-ritsu) determines how big you can build your 1st floor. However, if the 2nd floor is bigger than your 1st floor then the 2nd floor will be the area subject to this ratio. Parking space is not counted in this percentage as long as it is not a garage or there are no roof and columns over the space. Eaves and roofs that stick out more than 1m from the exterior wall of the house will also be counted as floor space area.

Relaxation to the land-to-building ratio can be granted when a house is built to be fully fire-resistant in a fire prevention district (or built to any similar standard approved by government ordinance), or built semi- or fully fire-resistant inside a semi-fire-prevention district. Separately, if the plot of land is on a corner lot, like on an intersection or deemed alike, and when the city local government has designated the area as applicable, then a 10% relaxation can be granted to the land-to-building ratio.

Building Volume-to-Land Ratio

The building volume-to-land ratio (容積率 Yo-seki-ritsu) determines the maximum possible floor area you can build totaled across all floors of your house. There is a general ratio for each zoning district, but it can be further restricted by the width of the frontal road multiplied by 0.4 in residential zoning districts, or by 0.6 in non-residential zoning districts. The lower of the general ratio and the frontal-road-width-based ratio is the applicable ratio.

Parking spaces are not counted in the building volume-to-land ratio as long as the total carpark area is less than 1/5 of the total floor area across the entire house, where the total floor area in the calculation includes the parking area; whether the parking space is open-air, roofed, or enclosed is irrelevant

Basements are excluded from the total floor area calculation as long as they meet the following conditions: (1) they are within one-third of the total floor area of the entire house, (2) the basement ceiling is less than 1 meter above ground level, (3) they are used for residence.

Height Restrictions

Height restrictions, based on a slant plane, may further restrict the volume of your house, and they are determined differently in each zoning district (用途地域 Yo-to-chi-iki). The restrictions include :

-

Absolute Height

-

Road Boundary Restriction

-

Adjoining Boundary Restriction

-

North-Facing Boundary Restriction

-

Solar Shade Control

Absolute Height Restriction

Category 1 and 2 Exclusive Low-Rise Residential Districts have an absolute building height restriction of 10 and 12 meters respectively.

Road Boundary Slant Plane Restriction

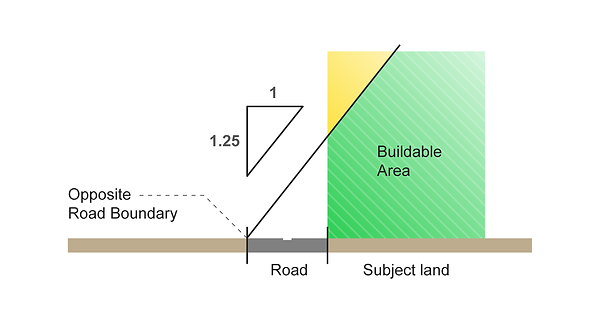

This restriction limits the building height in proportion to the distance between the house and the opposite side of the road they face.

The height must be lower than 1.25 or 1.5 times the horizontal distance between the house and the opposite road boundary.

The ratio is 1:1.25 in residential zoning districts and 1:1.5 in other zoning districts.

Adjacent Boundary Slant Plane Restriction

From a height of 20 or 31 meters, the top of the house must be lower than 1.25 or 2.5 times the horizontal distance between the top of the building and the boundary with the adjacent lot .

The ratio of 1.25 applies to residential zoning districts, while 2.5 applies to non-residential zoning districts.

This restriction is not applicable to Category 1 and 2 Exclusive Low-Rise Residential Districts since they have an absolute height restriction of 10 or 12 meters respectively.

North-Facing Boundary Slant Plane Restriction

This applies only to Category 1 and 2 Exclusive Low-Rise Residential Districts and Category 1 and 2 Exclusive Medium/High-Rise Residential Districts.

In Category 1 and 2 Exclusive Low-Rise Residential Districts, the restriction starts from a height of 5 meters. If there is an adjoining road in the north direction, the top of the house must be lower than 1.25 times the horizontal distance from the opposite road boundary. Otherwise, it must be lower than 1.25 times the horizontal distance from the adjoining boundary.

For Category 1 and 2 Exclusive Medium/High-Rise Residential Districts, the same restriction applies except that it starts from a height of 10 meters instead.

Solar Shade Control

Your house must not cast a shadow on your southerly adjoining neighbor for more than the determined number of hours specified respectively for each zoning district, standardized to between 8 am and 4 pm in the winter solstice.

The restriction is imposed at a horizontal distance of 5 m and beyond from the adjoining plot boundary and at a height of 1.5 – 6.5 m of your adjoining neighbor’s building. Your building shall not cast a shadow for more than 3 – 5 hours at a distance between 5 m and 10m, and 2 – 3 hours at a distance beyond 10m, with the exact number of hours depending on your zoning district.

This restriction is not applicable to commercial and industrial zoning districts.

Other factors that should be considered are the following.

Checklist of things you should be watchful of when purchasing land

・Boundary points

・Road Access

・Road Width

・Height Differences with Adjoining Lots

・Accessibility to Utility Outlets

・Soil Conditions

・Climate Risks

Boundary Points

Check if there are clearly marked boundary points with all adjoining lots, and who owns the boundary walls and fences. If there are any doubts regarding boundary lines with the neighbors, they should be cleared up by your seller before contract closing as this may create problems for you in the future.

It is always best to have an official survey map signed off by all adjoining landowners before contract closing, which documents that the boundary points are marked off and they are mutually agreed upon. Even if there is no official survey map provided by the seller, there should still be visible boundary points, and you can ask the seller to point them out to you at the site. If there are any boundary points in question, the seller shall have it determined with the adjoining owner before contract closing.

Road Access

Frontal road and frontages are also important aspects when searching for your property. You should determine not only how accessible the house is with your car, but also whether the frontal road is city approved or not. The latter tells you whether you will be allowed to newly build or re-build (collectively called “develop”) your house. If not, then you will not be allowed to develop a house on that site.

Moreover, the frontal road can either be a public or a private road, even if it is city approved. One thing to keep in mind when you become a joint owner of a private road is that, there may be rising costs to maintain the road which you will have to bear. Conversely, if you don’t own any share of the private road that your house fronts, and, for example, if your water pipes run underneath, you may need permission from the owner(s) to excavate the road when you need to fix or replace them, and you may be charged money for that. It is always best to have your seller obtain written permission from the owner(s) of the private road in advance to consent to you using and excavating the road when repair is needed.

The frontage of your property needs to be at least 2 meters wide (sometimes 3 meters depending on the length of the passage way), or else, a house is not permitted to be developed. You should be watchful for land shaped like a flagpole/battle axe which has a narrow street access. Points worth noting when you buy a house with a narrow street access are, you can be limited to the type of car you can park, and builders may not be able to access the lot with large vehicles carrying construction equipment, which will result in additional work costs for demolishing, redeveloping, remodeling your house in the future. Not to mention that, you may be surrounded in all direction limiting the amount of light the house gets and the view, etc. However, this type of land is generally said to cost 20 -30% less than properties with wider frontages.

Road Width

Within a city-planned area, roads need to be at least 4 meters wide. If your existing frontal road is less than 4 meters wide, or its centerline is less than 2 meters from your lot (or more if stipulated otherwise), you will have to give up land space to make up for the deficit if you ever want to build your house.

Height Differences with Adjoining Lots

You need to look out for any height differences with your immediate neighbors, as you may need to build an earth retainer to align the heights, or build a house with a deep foundation. If there are any old or deteriorating retaining walls between you and your neighbors, they may have to be put up anew as they may not be up to code. The cost for these could be anywhere between a few tens of thousands of yen to few tens of millions of yen depending on the size, structure, materials used, location, etc. You also need to add the cost to remove the existing old walls. For this reason, be sure to find out who owns the walls with your neighbors if there is doubt on who needs to bear the costs of rebuilding them, so that you will be better prepared to stand your grounds.

Accessibility to Infrastructure

When you buy a lot which comes with an old house or an empty lot which had a house once before, you would expect the infrastructure to be there. But the water pipes, for instance, may be too old and at risk of deterioration. So it is best to replace them for your new house. On the other hand, if existing pipes are too narrow, then you may want to replace them with larger pipes to ensure sufficient water flow.

If you are developing a lot which never had a house built on it before, or if your lot does not front to a public road which normally would have the main water, gas, and sewage pipes running underneath them, you will need to connect your utility pipes from where the main pipes are. This could mean you will need to establish infrastructure for the first time, and/or the distance from your lot to the main pipes could be lengthy. The distance and the route it needs to take will affect the overall installation costs. Also, bear in mind that your costs may not just be for the construction itself but there could be a setup fee charged by the Water Bureau, depending on locality, for the new establishment. Furthermore, if you front to or your main utility pipes run underneath a city-owned road or arterial road, since these roads are made thicker because they are busier streets, excavating costs will be higher.

Normally for electricity, the electric company would install electricity wires to your lot for free, establishing an electricity pole if needed to, but this is decided only upon consultation. If any existing electricity pole(s) has to be relocated elsewhere in order to develop your house on your lot because it is inconveniently located, etc., then you would need to obtain prior consent from your neighbors on where that transfer should be. There could be rising costs for it as well.

Soil Conditions

It is important to know whether the soil in your block of land is strong or weak which in turn provides your builder with the information needed for a suitable construction technique and the type and depth of the required foundation of the house. You should be cautious when the land is in low lying types of location where it can be affected by floods and heavy rain.

Whether it needs soil improvement or not will have a huge impact on the overall costs of your construction, and you may have a dispute with your seller in respect to who will bear the costs of improvement. Therefore, it may be a good idea to hire a soil engineer to perform soil testing prior buying the land. However, majority of sellers will not cooperate with such testing out of fear that the results might be unfavorable and they may be asked to lower the sales price, or have to shoulder any costs of conducting such test.

You may want to consider conducting a soil assessment to ensure that the plot of land does not have serious environmental problems such as contaminated soils or polluted water sources. Looking up old maps and closed registries can tell you the history of the land and how it has been used.

Climate Risk

With recent global climate changes, Japan, like many other countries, has suffered from severe floods from unprecedented rainfalls. It is extremely important to make sure your plot of land is not in a flood zone. Not only are floods seen typically in areas near rivers and oceans, but they may also be seen in low lying areas in inland locations, where wastewater treatment capacity cannot keep up with short-time heavy rainfalls which have become more common recently.

Loose saturated sand deposits which are found in reclaimed land, swamps, lagoons, former rivers, coastal regions of big rivers, natural embankment formed from past floods are all prone to liquefaction. Check to see whether or not the plot of land you are buying is in a liquefaction zone which is extremely important to know before making your buying decision.

Given that the prices of real estate in Tokyo are still not reflective of climate risks as much as it should, this is sign of people’s low level of awareness towards frequently occurring natural disasters seen in recent years. It is best you avoid buying real estate prone to natural hazard which could diminish your property values. You should not be blindsided by how great the real estate may look.

Buying an Apartment

If your plan is to buy an apartment in central Tokyo, your chances are far better if you search for both new and pre-owned apartments. Chances that a newly built apartment block is being sold in areas you like are relatively low.

Where you should buy would really depend on what the purpose of your purchase is. If your final aim is for investment then buying in central Tokyo would make most sense, as you can expect good rental demand and resell value. If it is for settling down and growing your family, perhaps moving farther away from the city will get you the extra space you need.

Even if you move farther out, it is highly recommended that you remain in proximity to the central wards or in areas with quick train access to Tokyo, as there is a greater chance of your property retaining value than other areas. Of course, if there are properties in the outskirts or in adjacent prefectures with additional value, such as being near popular beaches, big parks, or shopping facilities, or having a great view or attached outer space, etc., then that can be money well spent too.

As much as it is important to find a comfortable apartment, you should not neglect your due diligence to find out any issues that may burden you after you take possession. Look at the history of maintenance work done in the building and see if there is not a long list of work lined up. What are the latest topics discussed within the homeowners’ association (管理組合 Kanri-kumi-ai) general meetings? Does it have a long-term maintenance plan (長期修繕計画Choki-shuzen-keikaku) and is the reserve fund accumulating as the schedule projects? Does it have any negative events that happened in the past such as accidents or crimes? Are there any apartment fee delinquents amongst the homeowners? And so on.

Buying apartments that have a high monthly cost can also be financially burdensome. That means you may want to avoid apartment buildings that have few apartment units, unless your financial situation allows it.

From the management perspective, I would recommend an apartment that has an outsourced management company which is hands-on with the management operation of the apartment rather than a self-managed apartment, especially when you are a foreigner. The first reason is, if you do not speak Japanese, your voice will not be heard and you will just allow the management operation to be run by other people who may not know what they are doing. The second reason is, the apartment may not be conforming to a long-term maintenance plan which means the building may be low in its reserve fund for conducting essential maintenance repairs in the future.

Age of the building should be taken into consideration when purchasing an apartment in Japan as there is a high level of seismic activity across the country. Buildings that were built based on city-approved building plans before June 1st. 1981 are not up-to-date with current earthquake codes (耐震基準 Taishin-kijun) and they may be vulnerable to large earthquakes. However, some pre-1981 buildings may just be as strong as the ones built according to the current codes. So check to see if there has been any seismic diagnosis conducted in the past.

With recent global climate changes, Japan, like many other countries, has suffered from severe floods due to unprecedented rainfalls. It is extremely important to make sure you are aware of the flood risks in the area. Not only are floods seen typically in areas near rivers and oceans, but they may also be seen in low lying areas in inland locations, where wastewater treatment capacity cannot keep up with short-time heavy rainfalls which have become more common recently.

Buying an apartment may not be a once-in-a-lifetime event. You may need to upsize, downsize, relocate, or capitalize. Therefore, when buying real estate, you may need to look at resell value or future rentability. Not only does capital appreciation give you more freed-up cash, but for certain people it can also mean being able to offset the remaining loan.

You cannot always predict whether your real estate will retain or increase its value, which can be impacted by economic factors. But there are indicators which should be taken into consideration when purchasing your home that can make a difference.